On September 15th, Figma CEO Dylan Field released a message: Today, Figma announced that it has accepted the acquisition of Adobe...

Adobe's acquisition of Figma for about $20 billion is the largest acquisition in Adobe's history. What kind of magic did that make Figma acquired by Adobe? The following is a further analysis and disassembly of Figma based on positioning (users, products, markets, etc.) and PLG growth dimensions.

1. What is Figma?

Figma is an online collaboration tool for design founded by Dylan Field and Evan Wallace in 2012. Figma simplifies the collaborative process of thousands of companies in the design process. Its team size is around 1,200, and its accumulated 4 million users include designers, development engineers, product managers, etc.

Just as Zoom serves remote meetings and GitHub serves code management, it can be understood that Figma serves design collaboration.

Figma's vision is to make design accessible to everyone. The official website is as follows:

make design accessible to everyone.

From the vision, the user group is not just designers. According to statistics, 65% of Figma users are not designers.

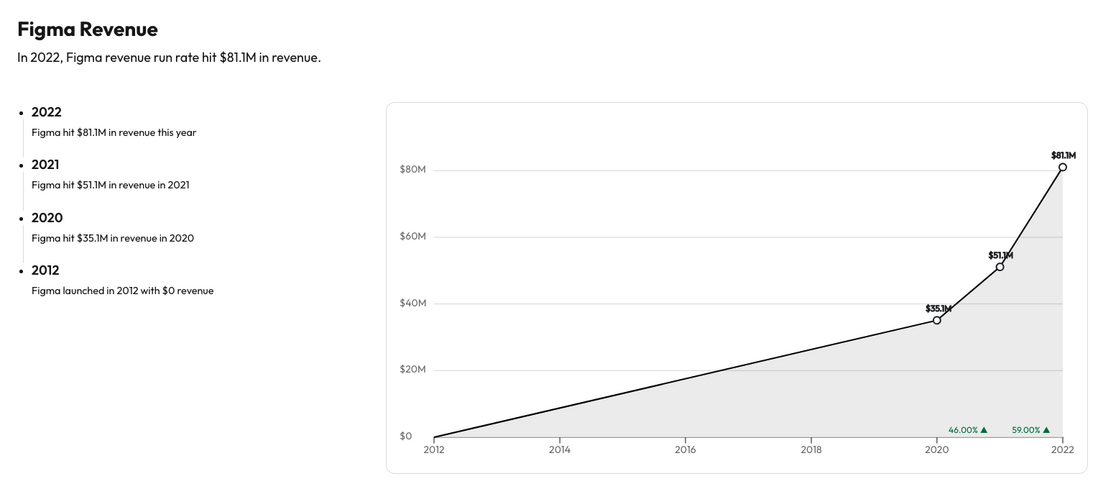

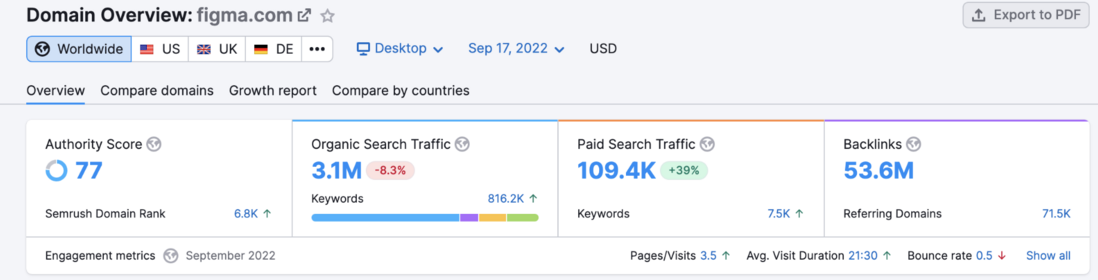

The last round of financing was in June 2021, and after the completion of $200 million in financing, the valuation reached $10 billion. With a valuation of $2 billion in 2020, the growth is simply magic. According to the statistics of the three parties, the 2020 revenue has reached 35.1 million US dollars, the 2021 revenue has reached 51.1 million US dollars, and the 2022 revenue is expected to be 81.1 million US dollars, an increase of about 50%.

Let's answer from the positioning dimension, what is Figma's product? Why is growth so magical?

Second, Figma positioning

2.1 User positioning

First, according to UXTools statistics: the proportion of mainstream UI design tools in recent years. Figma has grown more than other similar products in UI design tools.

From the above vision, we can see that the user group is not only for designers. The official website is as follows:

Figma connects everyone in the design process so teams can deliver better products, faster.

Brainstorm -> Design -> Build

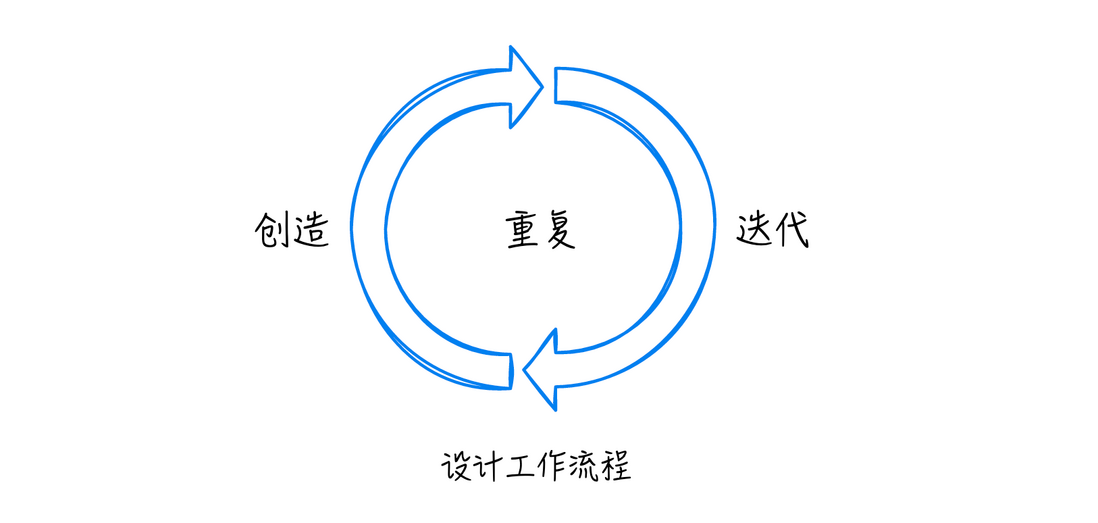

It can be understood as: in the design workflow, from the idea to the execution process, to the review. Almost all design-related work can be done in Figma. The entire process includes a creative phase and an iterative phase, and then continues to repeat:

There are different user groups related to design. Here are some common ones:

- Product Managers: Use Figma for product brainstorming, product workshops, prototyping, and more

- Designers: Design workshops, design drafts, design reviews, design sprints, and more with Figma

- Development engineer: use Figma to evaluate each other online, view the reference code snippet corresponding to the design draft, etc.

- Managers: Use Figma to view reports for work insight, team planning, team review, ice breaking, etc.

Its characteristics are real-time, sharing, collaboration, traceability, and transparent management. Figma also comes with a variety of templates to adapt to interactive meetings in different scenarios. Only the ability to create, on the Figma online whiteboard is omnipotent and can be adapted to different scenarios.

Divided by scene, it is divided into two product lines: FigJam and Figma

- FigJam (coming in 2021): Online collaborative whiteboard for teams

- Figma: Team all-in-one design collaboration platform

2.2 Market Positioning

The global team collaboration software market size was valued at USD 21.69 billion in 2021 and is expected to expand at a CAGR of 9.5% from 2022 to 2030. The promising growth prospects of the market can be attributed to the evolution of the modern workplace and the increasing need to integrate effective means of team collaboration across organizations.

Lockdowns and restrictions amid the pandemic have forced businesses around the world to implement remote work models in 2020, increasing demand for team collaboration software for virtual communications.

(Data source: Report ID GVR-2-68038-633-2)

In 2021, the Chinese enterprise team collaboration software market size will be US$380 million, a year-on-year increase of 39.1%. Among them, the scale of enterprise team collaboration software in the SaaS model was US$150 million, a year-on-year increase of 41.4%. In the future, the growth rate of the enterprise team collaboration SaaS market will be much higher than the local deployment model. It is estimated that in 2022, the enterprise team collaboration software market size will reach 460 million US dollars.

(Data source: IDC, China Business Industry Research Institute)

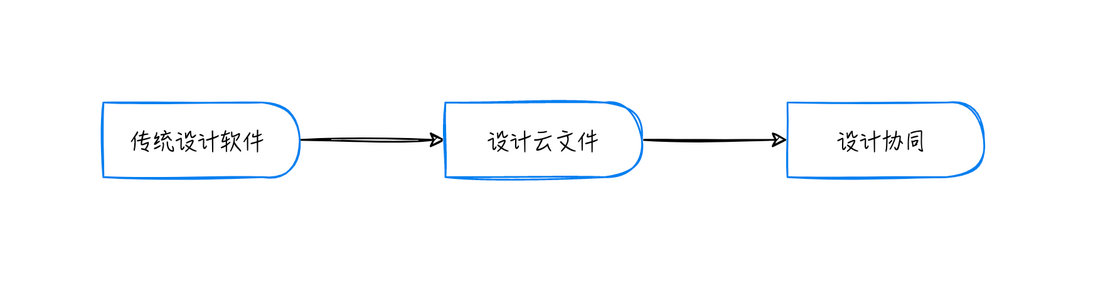

The market development of the design software industry is roughly as follows:

- The era of traditional design software: PS and other software meet design requirements, but there is no content precipitation and interaction and collaboration

- Design cloud file era: software such as document sharing realizes cloud files, and achieves the precipitation of design content, but there is no interaction and collaboration

- Design collaboration era: all in one integrated cloud service

Therefore, Figma's product positioning is to design collaboration, and design + collaboration scenarios are all in one .

2.3 Product positioning

Figma's development path

From the official Figma release notes (releases.figma.com) it can be seen that:

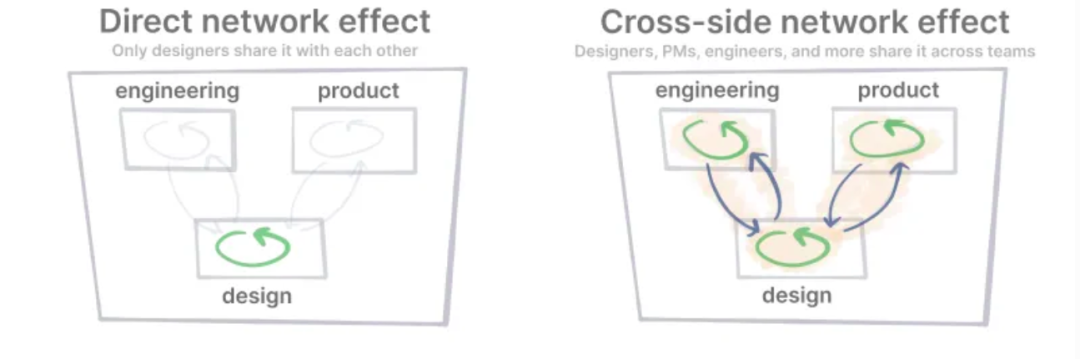

- Officially launched in 2015, it solves the pain points of designers and achieves direct network effects in the designer group

- In the next few years, it will focus on team collaboration, allowing team non-designers to participate in it, forming a cross-border network effect

- Then, more characters that need to be designed can use Figma to form penetration within the enterprise

- Finally, after achieving internal penetration of the enterprise, consider cross-enterprise collaboration to form a network effect between B-sides

Product Advantages of Figma

Figma product advantages can be divided into the following dimensions:

- Core functions

- Template function

- Plugin function

- widgets widgets

In some deep business scenarios designed, Figma support is really in place. For example, the Builder.io plugin can be downloaded from any competing website HTML to Figma. as the picture shows:

This is simply a designer's artifact, and I think of a sentence:

Good artists copy, great artists steal.

3. Growth Dimension (Key PLG)

3.1 Traffic composition

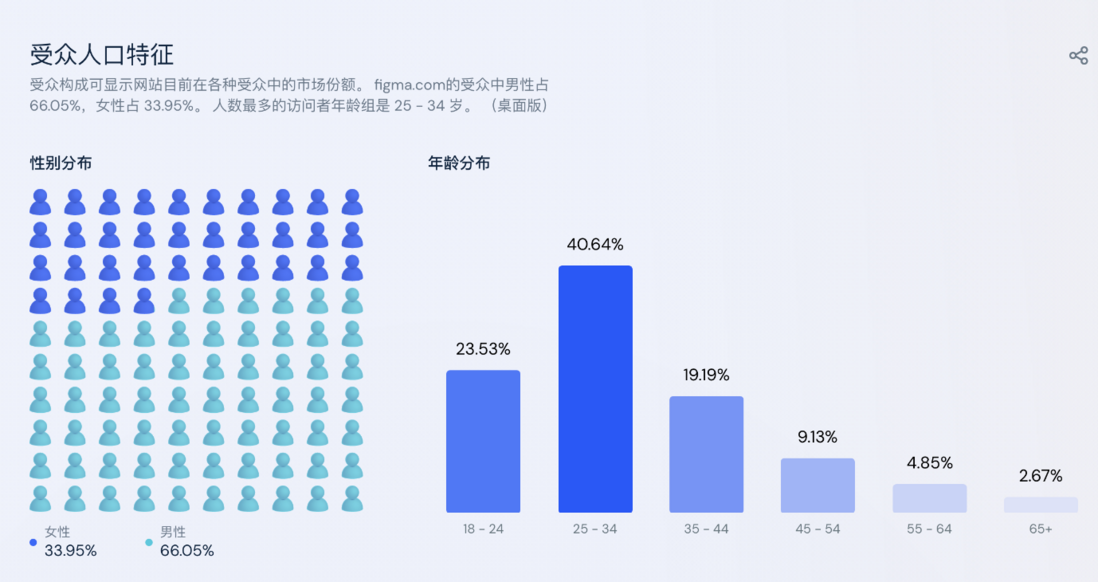

The current flow of Figma is as follows:

- Nearly 60 million visits last month

- The age characteristics of users are between 18 and 44 years old, accounting for more than 80% of the total

(Data source: similarweb)

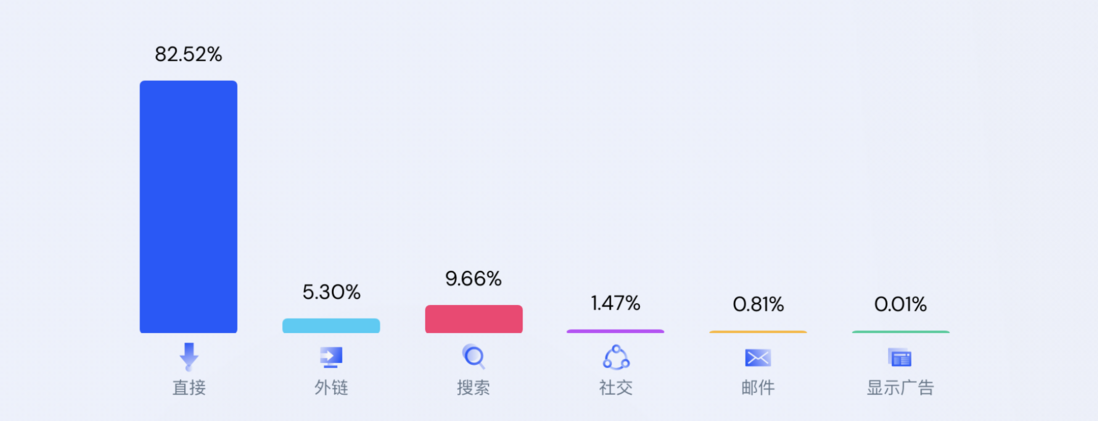

Figma's current traffic sources are as follows:

- Direct sources account for about 80%

- Search sources account for about 10%, and organic and paid search placements bring about 3 million visits

3.2 PLG Growth Disassembly

From the perspective of traffic sources, direct sources account for the largest proportion, and the core reason is the growth of Product-Led Growth (PLG). The key point of its PLG lies in the synergy mechanism. For example, design conferences, design collaborations, and design project management all have synergistic effects.

What is the core of PLG? I think it is relative. Compared with Marketing-led Growth (MLG), PLG has a few core points:

- Product-led growth, the product itself must be easy to use (just like WeChat and iPhone), including functions, visuals, interactions

- Product users can experience the core value of the product by themselves : the road is simple, less is more

- In the product itself, discover and implant growth features. For example, Figma relies on "collaboration", Youzan/WordPress relies on "powered by" and other models to form a network growth effect

- Before users need to pay and actively contact sales, users have already felt the value and brand power of the product

According to the PLG core, Figma's PLG growth is broken down as follows:

- Through basic initial promotion (SEO, social, placement, etc.), users sign up

- Under the guidance of templates and beginners, use the product in depth and become the target user of the product

- Introduce products into team collaboration to form network effects within the enterprise

- It will also bring the product to another enterprise through certain scenarios. Such as B2B external training, employee turnover, etc.

After a detailed experience of Figma products, I found that the user experience of Figma is really extreme:

- From the official website to the registration, the registration is completed in two simple steps: registration supports google third-party registration -> fill in a user name and select a user role.

- After entering, it will also remember the design draft address that the browser has visited.

- After entering, it comes with several default templates to quickly see the value of the product

- After creating the design content with Figma, the invitation is also simple

- Other users complete the closed growth loop through the invitation link

Don't get me wrong here for PLG growth:

First: product features

The core of PLG is P, which is product power.

- Figma is browser-first, and its WebGL technology lead enables digital products on the browser

- Not only cloud storage, but also cloud editing and team collaboration and interaction

- Similarly, Figma spends a lot of time working closely with users, and has never stopped in the thickening of products.

- The product is so important, the corresponding product data analysis is also very important

In this way, word-of-mouth communication is satisfied.

Second: consider whether the product is suitable for PLG leadership

If it is suitable for PLG to dominate, in terms of marketing ROI, then PLG growth dominates. So dominance is just dominance:

- Then SLG and MLG will not do it, obviously not. Figma has been doing it, and it's doing very well

- The growth of PLG also requires a certain number of seed users. The more seed users, the better the PLG effect.

In this way, both the collaborative mechanism propagation and the recommendation mechanism propagation are satisfied.

Third: PLG has nothing to do with free

Free-based, just some kind of strategy. But the value of business is the deal. A completely free strategy is not advisable. So we must consider the rhythm of commercialization in advance, how to design? In this way, it is possible to distinguish the real paying user group portrait as early as possible, which is conducive to subsequent decision-making on growth.

Therefore, the growth of PLG is mainly for better traffic growth, and it also requires sales to follow up and walk on two legs. On the road of growth + sales, we can better achieve the results of commercialization.

3. Summary

This article roughly summarizes Figma's related market dimensions, user dimensions, product dimensions, and finally dismantling its traffic composition and PLG growth.

A general summary of some of the key points of PLG shared:

- PLG products are bottom-up, closer to users and enterprises, and make progress together with users

- PLG products, users can experience the core value of the product by themselves

- For PLG products, users have already felt the value and brand power of the product before users need to pay and actively contact the sales.

- Not all products are suitable for PLG

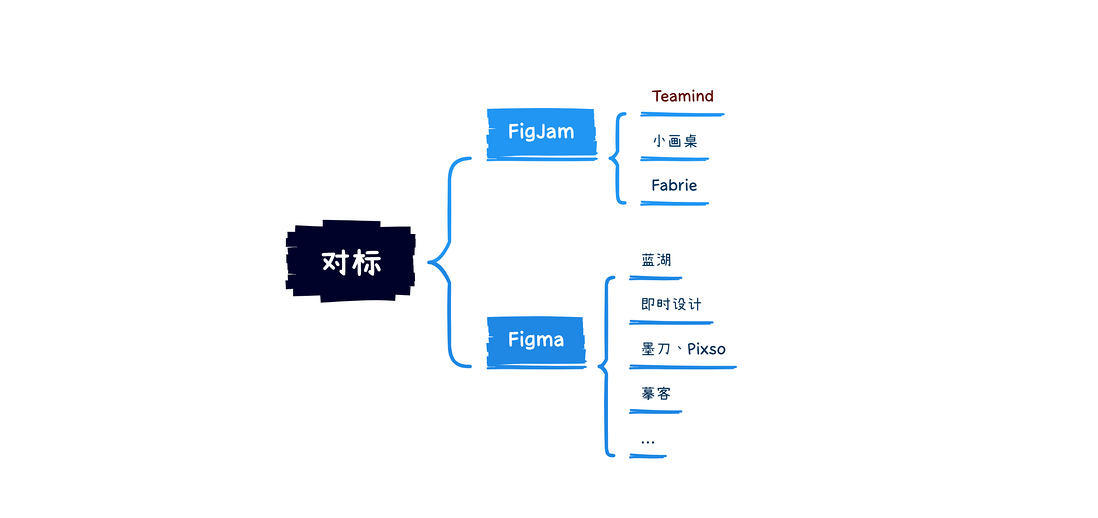

Finally, back in China, what are the collaboration tools related to the design of Figma? As shown in the figure:

Source: The public account "The Road to SaaS Entrepreneurship", an ordinary person on the road to SaaS entrepreneurship, likes to share some down-to-earth experiences and gains as much as he can

**粗体** _斜体_ [链接](http://example.com) `代码` - 列表 > 引用。你还可以使用@来通知其他用户。